Vat Taxes:

This is the Value-Added Tax added to cosmetic procedures created by FTA. You can add and configure the tax to Balsam Medico and have it automatically calculated on the necessary invoices.

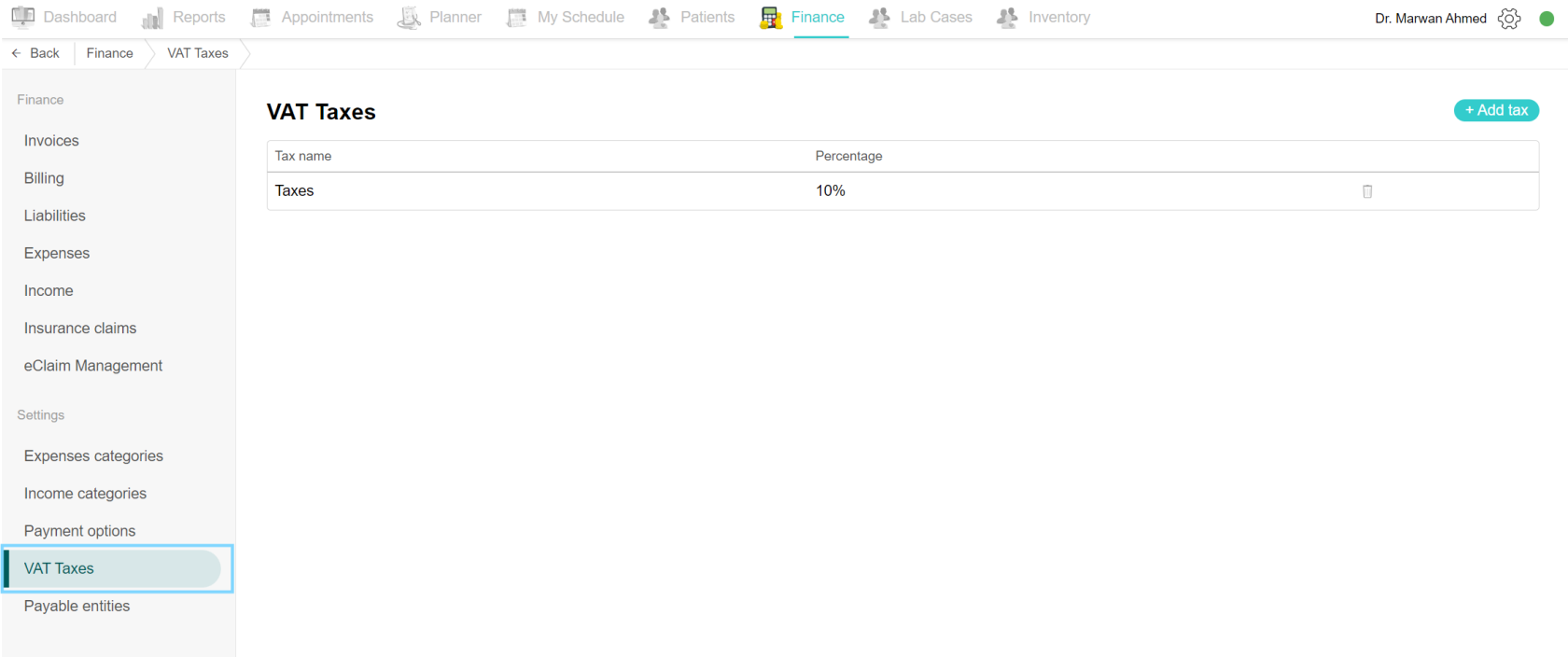

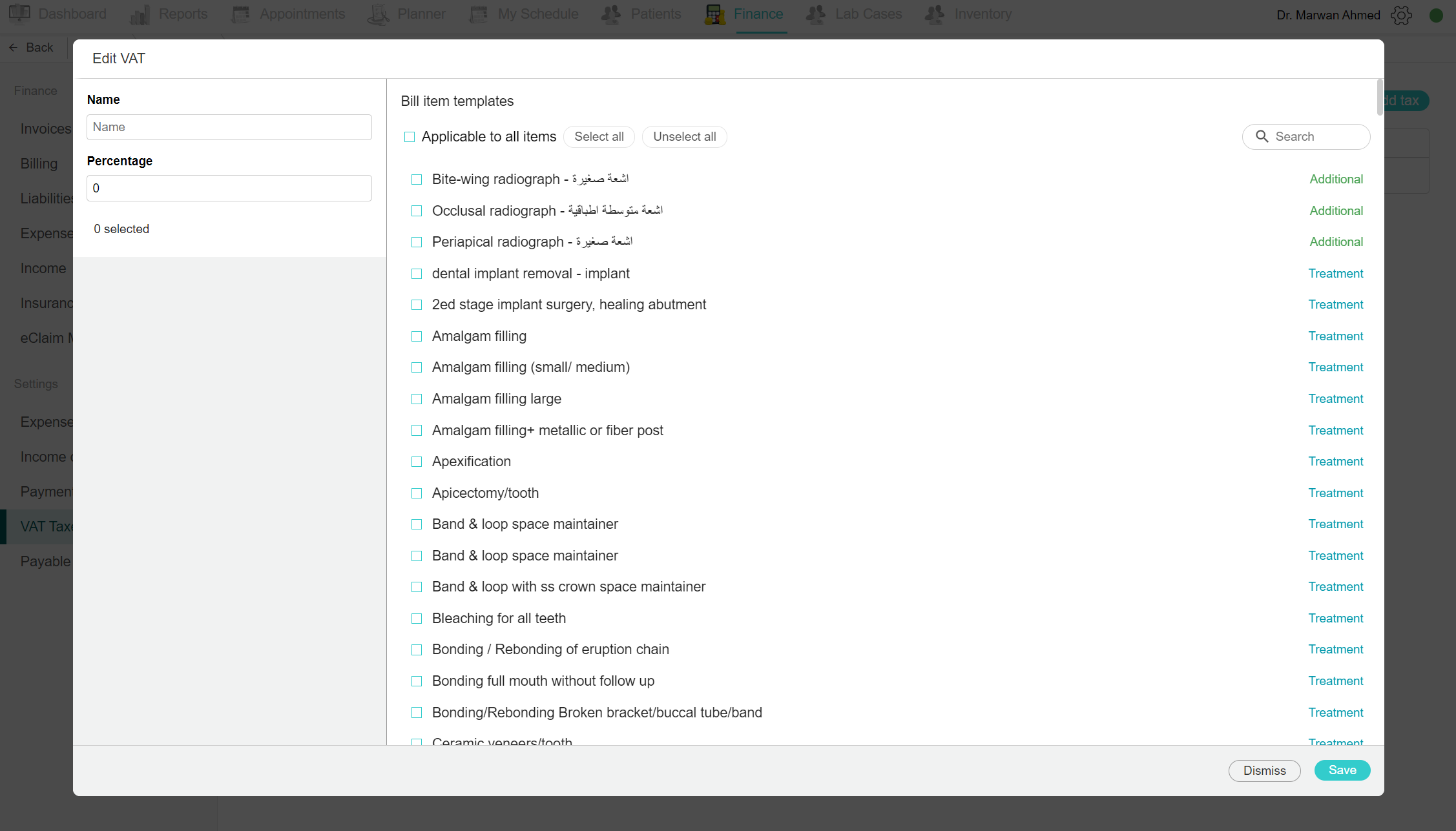

Add new VAT tax

Go to the Finance tab, under the Settings section, and click on VAT Taxes. A list of all the taxes is shown. To add a new tax, click on the “Add Tax” button. An Edit VAT page appears, on the left add the name of the tax and the percentage. Example: Name: VAT Tax and the Percentage: 5%. Now move to the right side and select the items to which this tax applies. If the tax is for all treatments and services, either click on the box next to “Applicable to all items” or click on “Select all”. After selecting the desired bill items, click save. Now every invoice that contains the selected bill items will have the tax auto-calculated and added to the invoice.

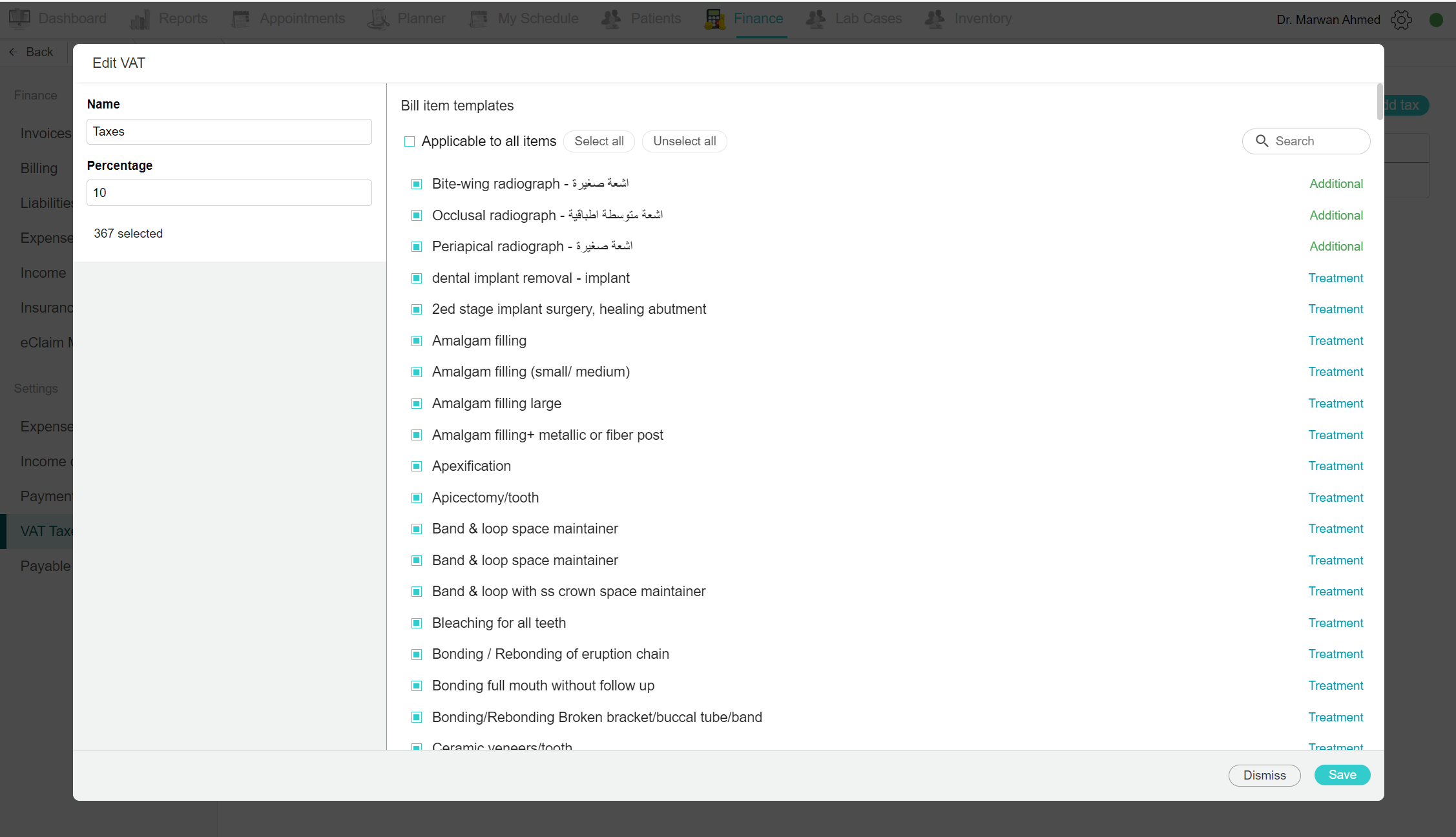

Edit VAT tax

To edit any VAT, go to the Finance tab and click on VAT Taxes under the Settings section. Click on the desired tax from the list. An edit VAT page opens, on the left side, edt the name and/or percentage. On the right side of the page, you can edit the list of bill items applicable to the tax. You can select or unselect the items from the tick box next to their name. Finally, click save.

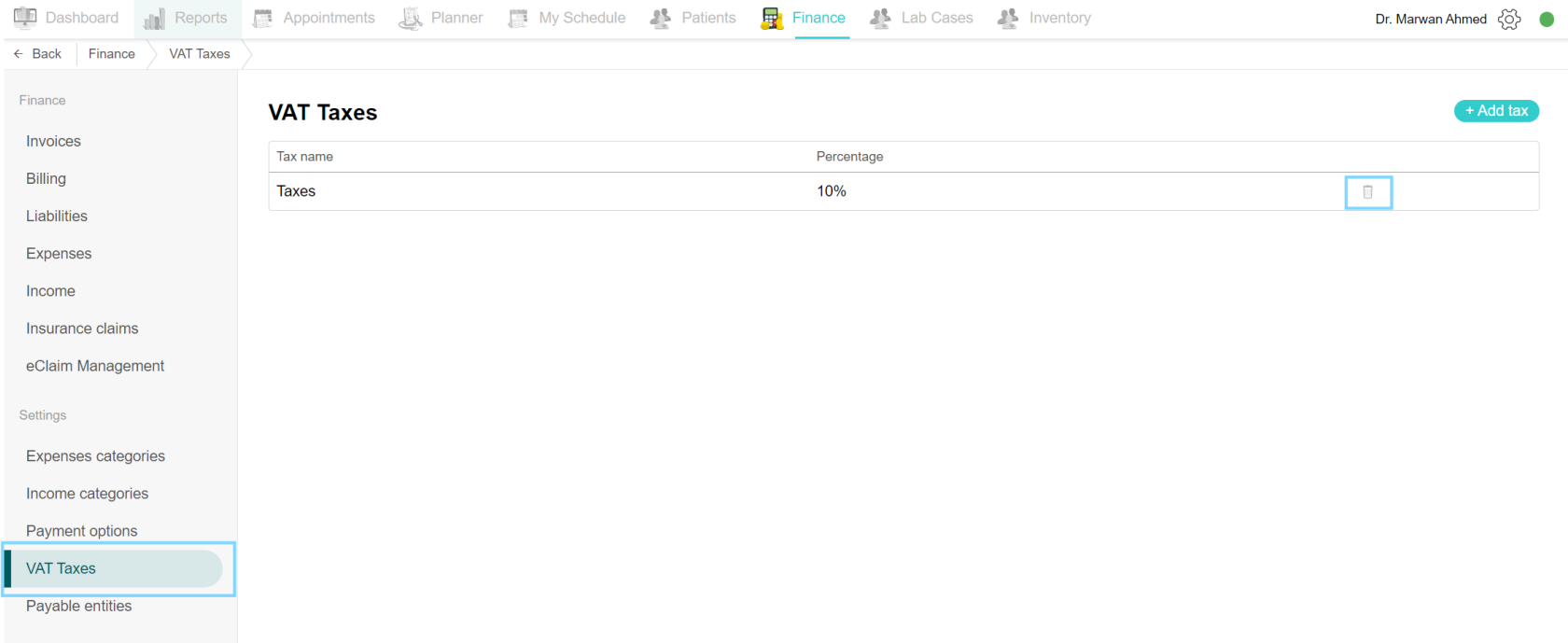

Delete VAT tax

Go to the Finance tab and click on VAT Taxes under the Settings section. Locate the desired tax you wish to remove from the list. Click on the delete icon on the same row of the VAT Tax name. Confirm by clicking the “Delete” button. Now it is no longer found on the list.